19-05-2017 (Important News Clippings)

To Download Click Here.

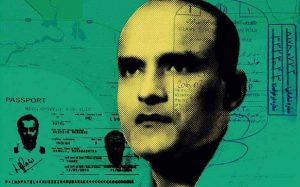

Kulbhushan Jadhav case

India’s bold decision to move ICJ pays off

While this is an interim order, for India it marks a significant diplomatic victory. India was able to demonstrate Pakistan’s disregard for international conventions and its propensity to undermine the rule of law. The ICJ has endorsed India’s contention that Pakistan has violated the Vienna Convention regarding consular access. It also made clear that Islamabad’s argument that the 2008 bilateral agreement on consular access justifies its decision to not give India consular access to Jadhav, as he was accused and subsequently found guilty of acts of espionage, was not in keeping with international norms.

The subordination of the 2008 bilateral agreement to the Vienna Convention is a victory for India as well, preventing Pakistan from proceeding againstIndian nationals in what are essentially secret trials — Jadhav was convicted by a military court without representation. In securing a unanimous verdict, India has succeeded in exposing Islamabad’s consistent undermining of international norms. It has also helped India overcome its diffidence over moving international fora when dealing with Pakistan for fear of internationalising Kashmir.This is, however, a temporary reprieve. But Pakistan would be hard put to flout the interim order. The ICJ will now hear the case on merits. New Delhi must marshal its arguments to definitively demonstrate Islamabad’s wilful disregard for the rule of law and international practice.

Date:19-05-17

Coal auction better than allocation

government should also get on with merchant mining

In parallel, the entire logistics of evacuating domestic coal needs revisiting. We need to augment the capacity to efficiently move coal from the hinterland, by ship and rail. In tandem, there’s the pressing need to increase investment in coal beneficiation, preferably of the dry kind, to conserve scarce water.

तीन तलाक पर कानून बनाने में दिक्कत क्यों?

व्यापक कर दायरा

सरकार का कहना है कि नोटबंदी के चलते 91 लाख नए लोग कर दायरे में आ गए हैं। यह अहम उपलब्धि है क्योंकि वर्ष 2015-16 में 370 लाख लोगों ने आयकर रिटर्न भरा था और यह आंकड़ा सीधे एक चौथाई का इजाफा करता है। इसके अलावा सरकार ने नोटबंदी के बाद जो खोज और सर्वेक्षण अभियान चलाए उनकी बदौलत करीब 23,144 करोड़ रुपये मूल्य की अघोषित आय सामने आई। सरकार पहले ही 18 लाख लोगों को चिह्निïत कर चुकी है जिनका नकद लेनदेन उनके कर प्रोफाइल से मेल नहीं खाता।

नए परमाणु संयंत्र

पोखरण में पहले परमाणु परीक्षण की वर्षगांठ के मौके पर केंद्रीय मंत्रिमंडल की ओर से की गई इस घोषणा का खास महत्व है कि स्वदेशी तकनीक आधारित दस परमाणु संयंत्र स्थापित किए जाएंगे और उनके जरिये 7000 मेगावाट बिजली हासिल की जाएगी। नि:संदेह परमाणु ऊर्जा में आत्मनिर्भरता के मामले में यह एक बड़ा फैसला है, लेकिन अच्छा होता कि ऐसा कोई निर्णय बहुत पहले ही कर लिया जाता। ऐसा इसलिए, क्योंकि अमेरिका से परमाणु करार के बाद विभिन्न देशों के सहयोग से परमाणु संयंत्र स्थापित करने की दिशा में कोई उल्लेखनीय प्रगति होती नहीं दिख रही थी। हालांकि अमेरिका के साथ हुए परमाणु करार को ऐतिहासिक करार दिया गया था, लेकिन ऐसा लगता है कि प्रमुख देशों के रुख-रवैये से परिचित होने के बाद मोदी सरकार इस नतीजे पर पहुंची कि विदेशी सहयोग से परमाणु संयंत्र लगाने से बेहतर है अपने बलबूते आगे बढ़ना। इस नतीजे पर पहुंचने के पीछे यह भी हो सकता है कि एक तो अमेरिका, फ्रांस, रूस आदि का परमाणु सहयोग महंगा सौदा साबित हो रहा था और दूसरे ये देश भारत के परमाणु आपूर्तिकर्ता समूह यानी एनएसजी में भारत की सदस्यता के लिए अपेक्षित कोशिश भी नहीं कर रहे थे। एनएसजी की सदस्यता में चीन रोड़ा बना हुआ है। परमाणु संयंत्र स्थापित करने में सहयोग देने के लिए आतुर देशों से यह अपेक्षित था कि वे चीन को भारत की राह में अड़ंगा न लगाने के लिए मनाएंगे, लेकिन शायद वे खानापूरी करने तक ही सीमित हैं। हैरत नहीं कि भारत ने इसी कारण चीन प्रायोजित वन बेल्ट-वन रोड सम्मेलन का बहिष्कार करने के बाद यह संकेत दिया कि वह रूस के साथ प्रस्तावित परमाणु समझौते को लेकर बहुत इच्छुक नहीं।स्वदेशी तकनीक आधारित दस परमाणु संयंत्र स्थापित करने की घोषणा यही बताती है कि भारत परमाणु ऊर्जा के मामले में दूसरे देशों की मदद का मोहताज नहीं। यदि वास्तव में ऐसा है तो फिर इतने दिनों तक अन्य देशों का मुंह क्यों ताका गया? फिलहाल यह स्पष्ट नहीं कि दस परमाणु संयंत्र कब और कहां बनेंगे? कहीं सरकार की इस घोषणा का मकसद बड़े देशों को कोई संदेश देना भर तो नहीं? जो भी हो, परमाणु ऊर्जा संयंत्र स्थापित करने में भारी भरकम खर्च के साथ ही उनसे जुड़े जोखिम की अनदेखी नहीं की जानी चाहिए। यह सही है कि परमाणु ऊर्जा स्वच्छ ऊर्जा के मकसद को पूरा करती है, लेकिन आज जब सभी प्रमुख देश परमाणु ऊर्जा की दिशा में मुश्किल से ही आगे बढ़ते दिख रहे हैं तब फिर भारत को भी यह देखना चाहिए कि इस क्षेत्र में कितना आगे बढ़ा जाए? वर्तमान में भारत परमाणु ऊर्जा से 6780 मेगावाट बिजली हासिल करता है और 6700 मेगावाट क्षमता पर काम चल रहा है। लक्ष्य यह है कि 2030 तक परमाणु ऊर्जा से 35 हजार मेगावाट और 2050 तक 60 हजार मेगावाट बिजली हासिल की जाए। चूंकि ऊर्जा जरूरत बढ़ती जा रही है इसलिए लक्ष्य पर ध्यान केंद्रित करना ही होगा, लेकिन बेहतर यही है कि ऊर्जा के अन्य विकल्पों पर भी महारत हासिल की जाए। इसलिए और भी, क्योंकि भारत इसके प्रति प्रतिबद्धता जता चुका है कि वह स्वच्छ ऊर्जा के क्षेत्र में विश्व का अगुआ बनेगा।

Culture Needs A Plan

Institutions for the arts need professional managers for a turnaround

This paper reported earlier this month that state-funded cultural institutions have been asked to generate revenue amounting to 25-30 per cent of their budget initially and “eventually” achieve “self-sufficiency”. The idea will remain utopian unless professional cultural managers are inducted to lead these institutions.

The government needs to create a cadre of professional cultural managers which calls for professionals with a host of skills and training, among which is the requirement to be sensitive and knowledgeable about the wide, diverse and complex cultures and traditions of the Subcontinent. Such persons alone will be able to create business plans for these decadent institutions, provide a vision to connect them to audiences and “markets”, evolve practical strategies to conserve traditional knowledge skills and creative expressions. Only then can these organisations create self-sustainability and have renewed relevance. In their present form, these are white elephants.

Most of these institutions are now led either by artists (performing or visual) who have no idea of or training in administration, policy or management. Or, they are run or controlled by non-specialist bureaucrats. The few professional cultural managers are not motivated to join since they are unable to provide appropriate remuneration and, most importantly, ensure functional autonomy. The dearth of professional cultural managers is unlikely to be addressed soon; not one eminent management institute in India offers a programme in cultural management.

Most state-run cultural institutions across India have been unable to chart a meaningful functional role for creative communities or the preservation of their cultural traditions. Relevant outreach programmes have also not been created. Cultural ecosystems are rocked when a cultural skill or knowledge dies. It is similar to what happens when the tiger is endangered — the impact is felt all over the ecosystem. Several knowledge systems related to performing arts, crafts in India and communities that practice them now face the threat of massive deskilling and marginalisation.

There is no cultural policy that offers a holistic and realistic approach to this complex, contested terrain. Committees to formulate policies are mostly formed with artists and cultural academicians; rarely are cultural management professionals or cultural economists invited to join them. Not surprisingly, these committees are unable to evolve strategies to ensure sustainability and conservation of creative communities, and other manifestations of our rich cultural heritage.

In the absence of professional cultural managers, bureaucrats in charge of these institutions take up the task of making India’s great cultural heritage visible on the international map. For example, the Festival of India model has not evolved since its inception in the 1980s. Those in leadership positions can’t grasp the international discourse on culture as they are unfamiliar with its vocabulary. They fail to address conceptual frameworks while keeping in mind the Indian context and Indian artists’ interests.

For instance, there is great attention given these days to ideas like cultural mapping and the conservation of intangible heritage, both by government and non-government institutions. However, there is a dearth of people who actually understand these complex issues or have the capacities to collect such data, which will involve large sums of public money. There is also a shortage of persons who are equipped to develop strategies to use the collected data in a manner that the welfare of the bearers of tradition, many of whom are living in poverty, are addressed. Just passing directions to recreate themselves as sustainable organisations will not generate the desired results, nor will a choice of leasing the land and infrastructure of these institutes to corporates provide a new functionality to these cultural institutions.There are, of course, people committed to the field of cultural management and economics. The question is, if the government will induct them as professionals, as they do with scientists, health professionals and economists? If the cultural sphere is not addressed in a systematic, detached and professional manner, we risk to lose huge capital. Culture is too precious to be left Ram bharose!

The writer is vice-president, Centre for New Perspective, an organisation that works on areas related to traditional skills and sustainable development

Date:18-05-17

What lies below the district?

Despite all the talk of decentralisation, nothing does. Nobody owns the planning and development functions in panchayat samitis and gram panchayats.

The oldest existing statute is the Bengal Districts Act of 1836. It is a statute with a single sentence and says the following, “Power to create new zilas: It shall be lawful for the State Government, by notification in the Official Gazette, to create new zilas in any part of West Bengal”. This is the text as it stands today, not as it was in 1836. There have been amendments in 1874, 1903, 1920, 1948 and 1950. The parallel legislation still exists in Bangladesh.

Two questions follow. First, why is such an old statute still on the statute books? Aren’t old laws being cleaned up and scrapped? The answer has to do with Article 372(1) of the Constitution. The Bengal Districts Act of 1836 will have to be repealed by the West Bengal Assembly. Second, why does Bengal (West Bengal) alone need a specific statute to create a zila (district)? Other states have sufficient powers under relevant land revenue legislation to create and define districts, sub-divisions of districts and even villages. The answer probably lies in the way land revenue legislation evolved. Since states can create and change districts, the number of districts varies. The 2001 Census had 593 districts, the 2011 Census had 640; the number has crossed 700 now. With that 2011 base, Uttar Pradesh had 71 districts and Lakshadweep had one.

Though not explicitly stated, more districts are presumably created for administrative convenience and delivering public goods and services better. Take the Upper Dibang Valley in Arunachal Pradesh. In 2011, this had a population of 7,984 and a geographical area of 9,129 square kilometres. This makes it India’s largest district, but one with the lowest population density. The district headquarter is Anini and you can imagine the distance of other parts of Upper Dibang from Anini.

When deciding on new districts, there are obvious criteria like population, geographical area and the distance from district headquarters. But the right answer isn’t always obvious. Once revenue laws have determined districts, government development programmes work through DRDAs (District Rural Development Agency), at least on the rural side; there are also elected representatives, through zila panchayats or parishads (ZPs) or district councils, further down to blocks and villages. The number of ZPs is 618, a little lower than the number of districts, because there are urban districts too. (All such numbers change, depending on the year.)

Once there is a new district, barring time-lags, there will also be a new ZP, through the relevant state election commission. Think of various entities involved in a district’s development — the district collector/district magistrate/district Commissioner, the DRDA, the MP, multiple MLAs and ZPs. Unless they work together, a lot of resources, not just financial, will be frittered away.

Because of the DRDA structure, it probably works at the district level. I am not suggesting it works perfectly. For instance, making the ZP president the chairperson of the DRDA doesn’t necessarily mean the ZP works in tandem with the DRDA. Below the district level, I don’t think it works at all.

There are 6,603 intermediate-level panchayats and 2,49,016 gram panchayats. At the district level, one can at least argue the DRDA chairperson has oversight about the district’s development and MPs or MLAs are part of the DRDA. In principle, it should be possible to work on district-level planning. That’s true even if the DRDAs are replaced by something like rural development cells in ZPs, to function as district planning committees.

However, I don’t think one can be that unambiguous at the sub-district level. Going back to the 1950s, government development programmes are through community development blocks (CD blocks), under the overall charge of a BDO (block development officer). Let’s take Andhra Pradesh as an example. The sub-unit of a district is a revenue division and the sub-unit of a revenue division is a mandal. I don’t need to give instances from other states since the point is a simple one. In different states, it is called a mandal, circle, tehsil, taluka, sub-division, CD block, but there is often a revenue division or circle above it.

Other than the BDO, there is the tehsildar/talukdar and the intermediate-level panchayat, variously referred to as the mandal, taluka or block panchayat or panchayat samiti. Sure, the BDO, MP and MLAs are members of the panchayat samiti. But there isn’t a sense that there is a coherent governance structure at the panchayat samiti level, straddling the elected, the executive and land and revenue administration, the last specifically mentioned because development typically requires land issues to be sorted out. Stated differently — no single entity is clearly responsible for a block’s development.

That argument extends lower down, to the gram panchayat, and these have got a substantial amount of resources, courtesy the Fourteenth Finance Commission. I am not merely making standard points about capacity, a lack of devolution of functions, funds and functionaries, convergence and separate cadres. Perhaps those are prerequisites before one can answer my question. Decentralised planning is meant to start from below and “below” doesn’t mean the district. Gram panchayats/gram sabhas are supposed to have several “planning” functions. The intention is to make planning participatory. But unlike the district, and like the block, we don’t have a coherent governance and administrative structure. Unlike even the panchayat samiti, there is no direct link between the executive and the elected in the gram panchayat.

Thus, unlike the district, who “owns” the planning and development functions in panchayat samitis and gram panchayats? I don’t think anyone does. Hence, whenever we talk about decentralised planning, we tend to think of districts — and nothing below.

The other debt issue: on the States’ finances

The deterioration in the finances of the States needs to be urgently addressed

For the first time in 11 years, in 2015-16 the combined fiscal deficit of India’s 29 States as a proportion of the size of their economies breached the 3% threshold recommended as a fiscally prudent limit by successive Finance Commissions. The Reserve Bank of India has warned that the States’ expectation to revert to the 3% mark in their 2016-17 Budgets may not be realised, based on information from 25 States. While the Central government has projected a fiscal deficit of 3.2% of GDP for this year, States expect to bring theirs down further to 2.6% — still higher than the average of 2.5% clocked between 2011-12 and 2015-16. Whichever way one looks at it, the steady gains made in States’ finances over the past decade seem to be unravelling. Chief Economic Adviser Arvind Subramanian has asserted that the 3% of GDP benchmark for the fiscal deficit of the States or the Centre is not a magic number. Yet, it serves as an anchor for fiscal discipline in a country whose two biggest crises in recent decades — the balance of payments trouble in 1991, the currency tumble in 2013 — were precipitated by fiscal irresponsibility.

Taking on the massive debt of their chronically loss-making power distribution companies, as part of the UDAY restructuring exercise steered by the Centre, has surely dented the States’ fiscal health significantly over the past couple of years. With private investment remaining elusive, the States’ focus on bolstering capital expenditure in sectors such as transport, irrigation and power is welcome (States’ capital expenditure as a proportion of their GDP has been higher than the Centre’s since 2011-12). But it is important that such funding remains sustainable and States stay solvent. Tepid economic growth hasn’t helped, and States have had to resort to higher market borrowings even after the Centre hiked their share from tax inflows to 42% from 32%, starting 2015-16. The Centre has been short-changing States by relying on special levies such as surcharges, cesses and duties that are not considered part of the divisible tax pool. So, instead of a 10% rise in the States’ share of gross tax revenue, the actual hike in 2015-16 was just 7.7%. The forthcoming Goods and Services Tax regime should, it is to be hoped, correct this anomaly to an extent. But there are other potential stress points: Pay Commission hikes, rising interest payments, the unstated risks from guaranteeing proxy off-budget borrowings by State enterprises, and the boisterous clamour for ad hoc loan waivers. The N.K. Singh panel on fiscal consolidation has recommended a focus on overall government debt along with fiscal deficit and a 20% debt-to-GDP ratio for States by 2022-23. Not just the Centre, but States (with outstanding liabilities to GDP of around 24% as of March 2017) also need to tighten their belts considerably from here, even as they await the constitution of the Fifteenth Finance Commission

रोकने के लिए पोर्टल

सरकार द्वारा ऑपरेशन क्लीन मनी नाम से आरंभ वेब पोर्टल इस मायने में महत्त्वपूर्ण है कि इस पर कालेधन से संबंधित छापेमारी की पूरी जानकारी डाली जाएगी। वास्तव में अभी तक जो भी जानकारी जनता के पास आती थी, वह सूत्रों के हवाले से मीडिया द्वारा जिसे हम पूर्ण और सटीक जानकारी नहीं कह सकते। इससे सटीक जानकारी मिल सकेगी तथा अुनमानों की संभावनाएं खत्म हो जाएंगी। यह प्रश्न हमेशा से उठता रहा है कि जब सरकार हर चीज का डिजिटलीकरण कर रही है तो फिर आयकर छापों से लेकर जो आय छिपाते हैं या जिनका जमा धन किसी तरह उनकी आय से ज्यादा है उन सबका रिकॉर्ड सार्वजनिक क्यों नहीं किया जाता? जैसे ही इसकी जानकरी साइट पर आएगी सब कुछ आइने की तरह साफ हो जाएगा। अगर कर विभाग छापेमारी की खबरों को वेबसाइट पर डालेगा तो उसका भय दूसरे लोगों के अंदर भी पैदा होगा। यही नहीं वेबसाइट उस प्रक्रिया की संपूर्ण जानकारी देगी जिसके चलते कर चोरी की पहचान की गई थी। साथ ही कार्रवाई को उल्लंघन के विशेष विभिन्न स्तरों-अत्यधिक जोखिम, मध्यम जोखिम, कम जोखिम और बहुत कम जोखिम के आधार पर उल्लेखित किया जाएगा। अत्यधिक जोखिम वाले व्यक्तियों या समूहों को तलाशी, जब्ती और सीधे पूछताछ जैसी कार्रवाई का सामना करना पड़ेगा। मध्यम जोखिम वाले कर चोरी करने वालों को एसएमएस या ई-मेल के जरिये सूचित किया जाएगा और बहुत कम जोखिम वाले लोगों पर नजर रखी जाएगी। हालांकि जब तक ऐसे लोगों की जांच पूरी नहीं होगी तब तक वेबसाइट पर व्यक्ति विशेष और समूहों की पहचान उजागर नहीं की जाएगी। यह भी एक उचित फैसला है। इस पोर्टल की एक उपयोगिता यह होगी कि उसके जरिये ऐसे लोगों पर नजर रखी जाएगी और पोर्टल पर उनको आगाह किया जाएगा जो लोग करदाता नहीं हैं। लेकिन उसके बावजूद वे बड़े लेन-देन कर रहे हैं। आगाह करने का मतलब होगा कि कर देना शुरू कर दीजिए नहीं तो आपके खिलाफ कार्रवाई होगी। इस प्रकार स्वच्छ धन अभियान के तहत आरंभ इस पोर्टल की प्रासंगिकता और बहुआयामी उपयोगिता अपने आप स्पष्ट है।